- Bull Market Bytes

- Posts

- 📉 Crypto Crash or Market Manipulation?! $450B Wiped! |Released 11 Oct 25|

📉 Crypto Crash or Market Manipulation?! $450B Wiped! |Released 11 Oct 25|

👀 100% China Tariffs Send the Markets in a Downward Spiral!

Today’s newsletter is brought to you by Fintech Takes! Read what senior leaders do to get ahead of trends, deals, and regulatory moves shaping the industry!

Welcome back to

BULL MARKET BYTES

Your byte of cryptocurrency insight where Bitcoin has jumped from the highest mountain without a parachute.

Hopefully there is a trampoline at the bottom . . . 😂

Here is what we have for you today!

📊 BLOCKCHAIN BREAKDOWN

Bitcoin introduces 2 bearish formations

Bullish pressure falls lower

Bitcoin must hold major support

Market manipulation may be behind this

📌 BULL MARKET BULLETIN

President Trump announced 100% tariff on China imports

South Africans can now use crypto at 650,000 stores

BITCOIN TECHNICAL ANALYSIS

Yesterday sent shockwaves throughout the cryptocurrency community!

We go from Bitcoin positioning to create a new all-time high to a massive crash that sends Bitcoin to its same price on the 1st of September!

Now, we are starting to question . . . is this “Uptober” or “Octobear?”

With Bitcoin moving from ~$123,000 to $107,000 in a matter of minutes, Bitcoin has moved from +7.65% to -1.26% in October.

We have witnessed a slight recovery in price from Bitcoin, but is it enough to reignite the bull market?

Let’s take a look, but before we do, a word from today’s sponsor!

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Thank you to Fintech Takes for sponsoring today’s newsletter!

With over $450 billion wiped from the cryptocurrency market in minutes, it is fair to question if the bull market has ended.

We saw a similar move in March of 2020 with the COVID-19 epidemic.

What you will find interesting is not only the fact that I need to increase my blood pressure medication after this crash in price . . .

But the fact that Bitcoin hit major support that we mapped out months ago and created a bungie like effect back to ~$114,000!

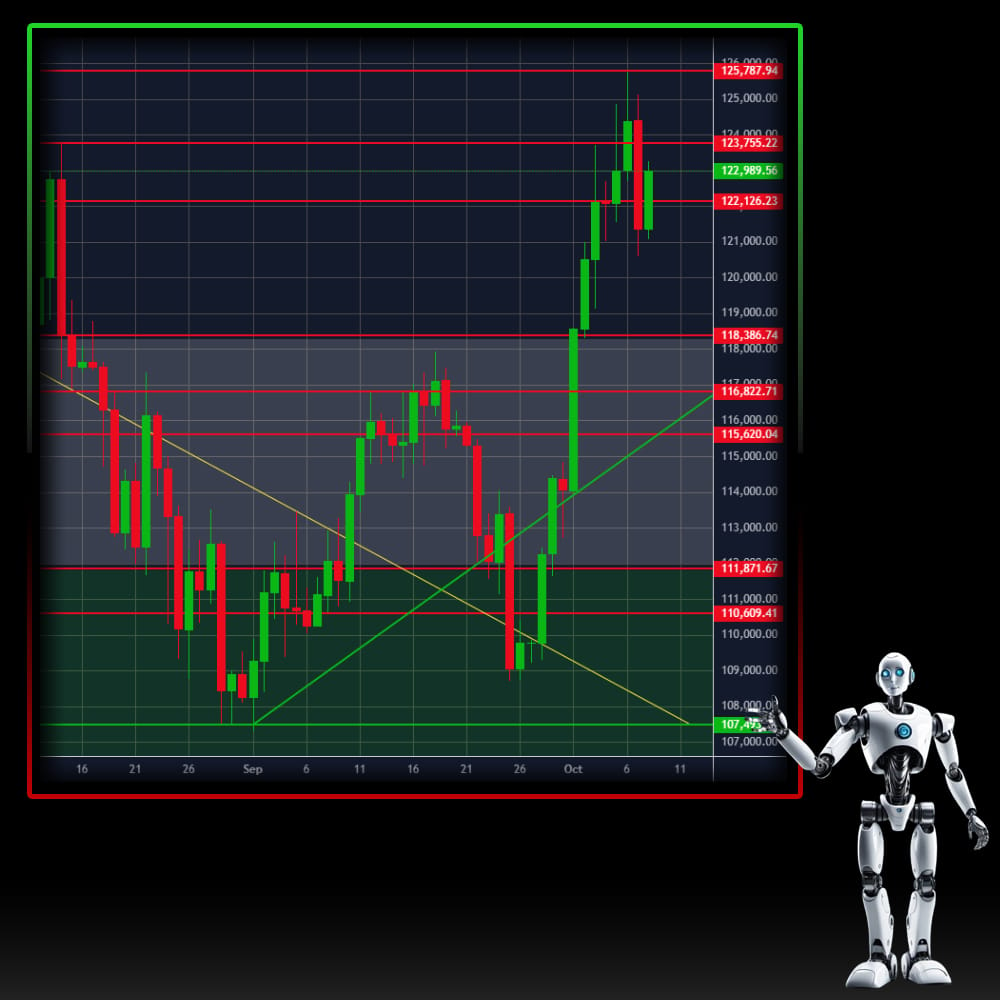

Below, the first image below is from 8 October - which shows a consolidation at the all-time high - and the second from the devastating crash.

Here is another example of the importance of charting! When Bitcoin crashed, Bitcoin bounced at major support at $107,493.48 and $111,871.67!

In the process, Bitcoin solidified 3 bearish moves:

Breaking the ascending support line

Breaking the bull flag formation

Creation of inverse cup and handle formation

Investors and traders are going to view this crypto crash as 2 separate things.

An opportunity to buy at a lower price point

The beginning of the bear market

We mentioned in our last newsletter that Bitcoin was “overextended and will result in a pullback,” but this is beyond unhealthy!

For a better idea of the market’s psychology behind the traders and investors, let’s take a look at the long-short ratio for the past hour!

Short (bearish) traders = 57.39%

Long (bullish) traders = 42.61%

So, what are our feelings on cryptocurrency’s downward spiral? Is the bull market ending or is this market manipulation?

WHAT TO ANTICIPATE

As stated in Wednesday’s newsletter:

Until our next newsletter on Saturday . . . see if Bitcoin holds $118,386.74.

If it doesn’t, $116,620.04 will be the next major support.

And to the cryptocurrency world’s surprise, Bitcoin hit 5 major supports along the way as the price crashed.

🌍 In a perfect world, what do we see? Even though Bitcoin has hit major support and recovered slightly, this may not be long lasting . . .

In a perfect world scenario, we need Bitcoin to hold above support at $111,871.67 at the very least!

We would have loved to see a higher uptick moments after the massive crash down in Bitcoin’s price, especially breaking above the ascending support line.

⚠️ Caution along the way! Bitcoin has created 2 bearish formations:

Bear flag formation between $107,493.48 and $115,620.04

Inverse cup and handle formation

To break the inverse cup and handle formation, Bitcoin needs to break above $116,822.71.

🧠 Our overall thoughts? This is solely our thoughts on this move . . . market manipulation!

Take SushiSwap diving to $0.19, Litecoin to $85, or XRP to $1.85.

Now, look at their price . . .

What a convenience it would be for someone to buy at that low level and immediately be in profit hours later . . .

There is no guarantee in the markets, but in our experience, let’s take a look at where the prices are in 3 weeks.

It wouldn’t be surprising if there is a full market recovery around the corner . . .

In the meantime, see if Bitcoin can retake $115,620.04 and then $116,822.71. If not, see if $111,871.67 will hold.

Until our next newsletter on Wednesday, be safe out there and no paper hands!

BULL MARKET BULLETIN 📌

South Africans can now use crypto at 650,000 stores via Scan to Pay

The transition from “hoarding to spending” Bitcoin expedites adoption

Trump announced a 100% tariff on China imports

Bitcoin drops from $123,000 to $107,000 in minutes

DID WE HIT THE BULLSEYE? |